Calculate Your Mortgage Loan in Sonoma, California

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Mortgage Loan Calculator for Home Purchases and Refinancing in Sonoma, California

At Summit Lending, we recognize that purchasing a home or refinancing a mortgage in Sonoma, California, is a major financial commitment. To simplify this process, we’ve developed an intuitive mortgage loan calculator that helps Sonoma residents estimate monthly payments and plan budgets with precision. Whether you’re a first-time buyer enchanted by Sonoma’s rolling vineyards, a family looking to settle in a vibrant community, or a homeowner seeking to reduce payments through refinancing, our tool delivers personalized results using current interest rates and loan terms. Based in Tremonton, Utah, Summit Lending proudly serves clients across California, Utah, Texas, Idaho, and Wyoming with over 50 years of combined expertise in the mortgage industry.

Calculate Your Mortgage Loan in Sonoma, CA

Understanding your mortgage payment is a critical step in buying a home or refinancing. Our calculator helps you budget effectively, confirm affordability, and plan for your financial future in Sonoma, where the median home price, according to the California Association of Realtors, was approximately $800,000 in 2023, reflecting the area’s desirability and proximity to the Bay Area.

Calculating Your Mortgage Payment

Your monthly mortgage payment typically includes four components, often referred to as PITI, which you should factor in when using our home loan calculator:

- Principal (P): The portion of the loan amount you’re repaying.

- Interest (I): The cost of borrowing the principal, based on your interest rate.

- Taxes (T): Property taxes, which in Sonoma County average around 0.8% of home value annually, per the Tax Foundation.

- Insurance (I): Homeowners and potentially mortgage insurance, depending on your down payment.

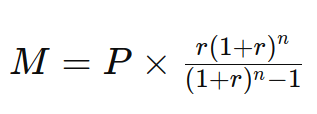

Mortgage Payment Formula with Our Home Loan Calculator

Use this formula to estimate your fixed-rate home loan payment (‘M’ for mortgage) each month:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in years multiplied by 12)

Expected Loan Payment Costs in Sonoma, CA

For example, if you secure a 30-year loan for $600,000 at a 4.5% interest rate. Common in late 2023 per Freddie Mac data. Your monthly payment for principal and interest would be around $3,040. Add Sonoma’s property taxes (approximately $6,400 annually or $533 monthly for a median-priced home), insurance, and possible HOA fees, and your total could rise significantly. Use our Mortgage Calculator for a detailed breakdown tailored to your unique circumstances in Sonoma.

Why Use a Mortgage Loan Calculator?

Mortgages involve numerous variables. Interest rates, loan terms, down payments, and local taxes. That impact your monthly costs. Our calculator demystifies these factors, offering clarity for Sonoma residents. Here’s why it’s invaluable:

- Estimate Monthly Payments: Input loan details to preview your potential payment.

- Compare Loan Options: Test scenarios like a 15-year versus 30-year mortgage to match your budget.

- Account for Additional Costs: Include Sonoma-specific taxes, insurance, and PMI for accurate estimates.

- Evaluate Refinancing Savings: See how a lower rate or adjusted term could reduce costs over time.

Our tool uses real-time market data to reflect current conditions, ensuring informed decisions. Visit our Loan Calculator page to get started.

Home Buying in Sonoma, California

Sonoma, located in the heart of California’s wine country, is a dream destination for home buyers seeking charm, culture, and natural beauty. Known for its historic plaza, world-renowned wineries, and proximity to San Francisco (just 45 miles north), Sonoma offers a unique lifestyle. The area’s real estate market is competitive, with a median home price of $800,000 as of 2023, according to Redfin, driven by demand for both primary residences and vacation homes. Despite higher costs, Sonoma’s small-town feel, excellent schools, and access to outdoor activities like hiking in Sonoma Valley Regional Park make it worth the investment.

Property taxes in Sonoma County are moderate compared to other California regions, averaging 0.8%, but buyers should anticipate larger down payments due to elevated home values. Using our loan calculator, you can input local data to determine affordability. For personalized guidance, explore our Purchase Loans page or connect with our Loan Officers who understand California’s nuanced market.

Refinancing Your Mortgage in Sonoma, CA with Summit Lending

Refinancing offers Sonoma homeowners opportunities to lower payments, shorten loan terms, or access equity for home improvements. Especially valuable in a high-value market. With interest rates hovering around 6.5% for a 30-year fixed mortgage in late 2023 (per Freddie Mac), now could be the time to explore options. Our calculator lets you compare current loan details with new terms to uncover savings. Benefits include:

- Lower Interest Rates: Refinance to save thousands if rates have dropped since your original loan.

- Adjust Loan Terms: Switch to a shorter term for faster payoff or extend for lower monthly costs.

- Cash-Out Refinance: Tap into equity for renovations or to consolidate debt, leveraging Sonoma’s high property values.

Summit Lending offers tailored refinancing solutions for Sonoma residents. Learn more on our Refinance Loans page or contact us for a consultation.

How to Use Our Mortgage Loan Calculator

Our easy-to-use calculator provides quick estimates for Sonoma home buyers and homeowners. Follow these steps:

- Enter Loan Amount: Specify the amount for a purchase or remaining balance for refinancing.

- Select Loan Term: Choose from terms like 15, 20, or 30 years.

- Input Interest Rate: Use the default rate or a quoted rate for precision.

- Add Additional Costs: Include Sonoma County’s property taxes (0.8%), insurance, and PMI if applicable.

- View Results: See your estimated monthly payment, total interest, and amortization schedule instantly.

While our calculator offers a solid starting point, every situation is unique. For a custom quote, call us at 385-200-1470 or email [email protected].

Why Choose Summit Lending for Sonoma, CA?

With over 50 years of combined experience, Summit Lending is your trusted partner for mortgage solutions in Sonoma and across California, Utah, Texas, Idaho, and Wyoming. Here’s what sets us apart:

- Regional Expertise: We understand California’s diverse markets, including Sonoma’s unique wine country appeal.

- Comprehensive Loan Options: From purchase and refinance loans to construction loans, reverse mortgages, and commercial loans, we cover all needs.

- Client-First Approach: Our brokers guide you through every step. See client feedback on our Testimonials page.

- Helpful Resources: Access tools like pre-approval assistance and support for first-time buyers.

Located at 305 E Main Street Suite 202, Tremonton, UT, we’re just a call or email away. Learn more about us on our About page.

Understanding Mortgage Factors in Sonoma, California

Mortgage costs in Sonoma are influenced by local conditions. Property taxes, at 0.8%, are reasonable for California but higher than states like Utah or Wyoming. Home values, averaging $800,000, often necessitate larger down payments or PMI for loans with less than 20% down. Additionally, Sonoma’s status as a tourist destination can impact insurance costs due to risks like wildfires, with annual premiums averaging $1,200-$1,500, according to the Insurance Information Institute. Inventory shortages, noted by the Sonoma County Economic Development Board, also drive competition, pushing prices upward.

Our calculator helps factor in these costs, but for deeper insights, connect with our loan officers who specialize in California markets. We can also guide you on state-specific programs, like California’s first-time buyer assistance, to ease the financial burden.

Take the Next Step with Summit Lending in Sonoma, CA

Ready to move from estimates to action? Whether buying a home or refinancing in Sonoma, California, Summit Lending is here to support you. Start with our mortgage loan calculator, then reach out for a personalized consultation. Call 385-200-1470, email [email protected], or visit our office in Tremonton, UT. Stay informed with mortgage tips on our Blog.

Don’t let financial uncertainty delay your goals in Sonoma’s beautiful wine country. With Summit Lending, you have a dedicated partner. If you’re ready to apply, upload your documents securely at this link. Start calculating your mortgage today and take the first step toward a brighter future!

Disclaimer: Results from our mortgage loan calculator are estimates based on provided data and current market conditions. Actual terms, rates, and payments may vary. Contact Summit Lending for accurate quotes and loan approval.