Calculate Your Mortgage Loans in Austin County, Texas

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Calculating Mortgage Loans for Home Purchases and Refinancing in Austin County, Texas

Understanding how to calculate your mortgage payments is a vital step in the journey to homeownership or when considering refinancing. Whether you're looking to buy a home in the serene landscapes of Austin County, Texas, or refinance an existing property to take advantage of lower rates, having a clear picture of your financial commitments is essential. At Summit Lending, we are dedicated to helping residents of Austin County navigate the mortgage process with ease. This comprehensive guide will walk you through calculating mortgage payments, using tools like our Loan Calculator, understanding associated costs, determining affordability, and exploring options to lower your monthly payments.

How to Calculate Your Mortgage Payments

Mortgage payments are typically made on a monthly basis and consist of four main components, often referred to as PITI: Principal, Interest, Taxes, and Insurance. The principal is the portion of the payment that goes toward reducing the original loan amount, while interest is the cost of borrowing that money. Taxes are based on the property’s assessed value in Austin County and are collected by local government entities. Insurance includes homeowners' insurance and, in some cases, private mortgage insurance (PMI) if your down payment is less than 20% of the home’s value.

Calculating your mortgage payment manually can be complex due to the variables involved, but understanding the basics can help you make informed decisions. Let’s break it down with the standard formula for a fixed-rate mortgage, which is the most common type for home purchases and refinancing.

Mortgage Payment Formula

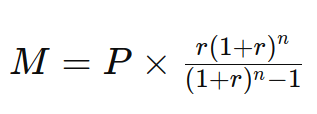

The formula to calculate the monthly mortgage payment (M) for a fixed-rate mortgage is:

Where:

Where:

- P is the principal loan amount (the total amount borrowed)

- r is the monthly interest rate (annual interest rate divided by 12)

- n is the number of payments (loan term in years multiplied by 12)

For a practical example, consider a $300,000 loan with a 4.5% annual interest rate over a 30-year term. The monthly interest rate would be 0.00375 (4.5% divided by 12), and the total number of payments would be 360 (30 years multiplied by 12). Plugging these numbers into the formula, the monthly payment for principal and interest would be approximately $1,520. However, this does not include taxes or insurance, which vary based on location and property value in Austin County. To get a precise estimate tailored to your situation, use our Loan Calculator for up-to-date interest rates and detailed breakdowns.

Typical Mortgage Payment Costs in Austin County, Texas

The cost of your mortgage payment in Austin County depends on several factors, including the loan amount, interest rate, loan term, property taxes, and insurance premiums. According to recent data from the Texas Association of Realtors, the median home price in Austin County is around $280,000 as of 2023, which is significantly lower than in nearby urban areas like Houston. For a $280,000 loan at a 4% interest rate over 30 years, the monthly principal and interest payment would be approximately $1,337. Adding property taxes, which in Austin County average about 1.8% of the property value annually (or $420 per month for a $280,000 home), and homeowners' insurance (around $150 per month), the total monthly payment could be closer to $1,907.

Other costs to consider include PMI if your down payment is less than 20%, and possibly homeowners' association (HOA) fees if you purchase in a managed community. These additional costs can significantly impact your monthly budget, so it’s crucial to account for them when planning. For a more accurate estimate of your total payment, including taxes and insurance specific to Austin County, visit our Loan Calculator and input all relevant details.

How a Mortgage Calculator Can Help

Mortgage calculators are indispensable tools for anyone considering a home purchase or refinance in Austin County. At Summit Lending, we provide an easy-to-use Loan Calculator to assist you in:

- Estimating your monthly mortgage payments based on current interest rates and loan terms

- Understanding how variations in down payment or interest rates impact your monthly costs

- Calculating the benefits of making extra payments to reduce the loan term and total interest paid

Using a mortgage calculator offers clarity and helps with financial planning by providing a detailed view of your future obligations. This is especially useful in a market like Austin County, where property values and tax rates can vary by area. Whether you’re buying a home in Bellville, Sealy, or Wallis, our calculator can help you tailor your budget to fit local conditions.

What Kind of Home Can You Afford in Austin County?

Determining how much house you can afford in Austin County depends on your income, existing debt, down payment amount, credit score, and current mortgage interest rates. A widely accepted guideline is the 28/36 rule: your monthly mortgage payment should not exceed 28% of your gross monthly income, and your total debt payments (including the mortgage) should not surpass 36% of your gross income. For example, if your monthly gross income is $6,000, your mortgage payment should ideally be no more than $1,680, and total debt payments should not exceed $2,160.

However, these ratios can vary based on personal circumstances and lender requirements. In Austin County, where housing is relatively affordable compared to nearby Houston, many buyers find they can purchase larger homes or properties with land for the same price as a smaller urban condo. Additionally, programs for first-time home buyers can offer down payment assistance or lower interest rates, increasing affordability. To explore your options and get pre-approval, contact Summit Lending today at 385-200-1470 or via our contact page.

How to Lower Your Monthly Mortgage Payment

Lowering your monthly mortgage payment can make homeownership or refinancing more manageable, especially in a growing market like Austin County. Here are several strategies to consider:

Larger Down Payment:

Increasing your down payment reduces the principal loan amount, which lowers your monthly payment and may eliminate the need for PMI. For instance, on a $300,000 home, a 20% down payment ($60,000) versus a 10% down payment ($30,000) could save you hundreds per month in PMI and interest.Longer Loan Term:

Choosing a longer loan term, such as 30 years instead of 15, spreads the repayment over more months, reducing your monthly payment. However, this increases the total interest paid over the life of the loan.Refinance:

Refinancing your mortgage at a lower interest rate can significantly reduce your monthly payments and overall interest costs. With refinance loans from Summit Lending, you can explore options to lower your rate or adjust your loan term. Be mindful of closing costs and how long you plan to stay in the home before refinancing.Property Tax Appeal:

If you believe your home’s assessed value is too high, you can appeal your property tax assessment with Austin County authorities. A successful appeal could lower your tax burden, reducing your monthly escrow payment.Shop for Insurance:

Comparing homeowners' insurance policies can help you find a more competitive rate, especially important in Texas where weather-related risks can drive up premiums. Lower insurance costs directly reduce your monthly payment.

Why Choose Summit Lending for Your Mortgage Needs in Austin County?

At Summit Lending, we understand the unique real estate market in Austin County, Texas, from the historic charm of Bellville to the growing communities in Sealy. Our team of experienced mortgage brokers and loan officers, with over 50 years of combined expertise, is committed to finding the best loan solutions for your home purchase or refinance. We offer a wide range of services, including purchase loans, refinance loans, and assistance for first-time home buyers, ensuring that every client receives personalized guidance.

Austin County’s appeal lies in its affordability, with median home prices well below the state average, and its proximity to Houston, offering residents a balance of rural tranquility and urban access. According to the U.S. Census Bureau, the county’s population has been steadily growing, driven by families and retirees seeking affordable housing and a high quality of life. This makes it an excellent time to invest in property or refinance to take advantage of favorable market conditions. Summit Lending stays updated on local trends and interest rates to provide you with the most competitive mortgage options.

Additional Considerations for Austin County Residents

When calculating mortgage payments for properties in Austin County, it’s important to consider local factors that can influence costs. Property taxes in Texas are among the highest in the nation, and while Austin County’s rates are moderate compared to urban counties, they still impact monthly payments. Additionally, homeowners’ insurance costs can vary due to risks like flooding or severe weather, common in this region. Working with Summit Lending ensures you receive advice on how to mitigate these costs, whether through insurance shopping or exploring tax exemptions for which you may qualify.

For those considering construction loans to build a custom home on one of Austin County’s many rural lots, we can help calculate costs specific to new builds, including permits and contractor fees. Similarly, for investors eyeing commercial loans in the county’s growing business districts, our team provides expert guidance on financing options.

Contact Summit Lending Today

Calculating your mortgage payments is just the first step toward achieving your homeownership or refinancing goals in Austin County, Texas. At Summit Lending, we’re here to provide expert support, answer your questions, and guide you through every stage of the process. Whether you’re ready to use our Loan Calculator, explore pre-approval, or discuss specific loan products like reverse loans, our team is just a call or click away.

Reach out to us today by calling 385-200-1470, emailing [email protected], or visiting our contact page. You can also stop by our office at 305 E Main Street Suite 202, Tremonton, UT 84337. Let Summit Lending help you secure the best mortgage solution for your needs in Austin County, Texas. Learn more about our services and team on our About page or read what our satisfied clients have to say on our Testimonials page.

Conclusion

Calculating mortgage payments and understanding the factors that influence them are critical steps in the home-buying or refinancing process in Austin County, Texas. By using tools like Summit Lending’s Loan Calculator, considering all associated costs, and exploring strategies to reduce monthly payments, you can make informed decisions that align with your financial goals. The unique appeal of Austin County, with its affordable housing and strategic location, makes it a prime spot for homeownership and investment. Partner with Summit Lending to navigate this process with confidence, ensuring financial stability and success in your real estate endeavors. Contact us today to get started!