Calculate Your Mortgage for Home Purchases & Refinancing in Dallas County, TX

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Calculating Mortgage Loans for Home Purchases and Refinancing in Dallas County, TX

Understanding how to calculate your mortgage payments is a critical step in the journey of home buying or refinancing, especially in a dynamic market like Dallas County, Texas. Whether you're a first-time homebuyer, looking to upgrade, or seeking to lower your current mortgage payments through refinancing, having a clear picture of your financial commitments is essential for effective budgeting and long-term planning. At Summit Lending, we are dedicated to helping residents of Dallas County navigate the mortgage process with confidence. This comprehensive guide will walk you through the intricacies of mortgage calculations, the unique aspects of the Dallas County real estate market, and how our expert team can assist you in securing the best loan options. For a quick estimate of your payments, try our Loan Calculator.

How to Calculate Your Mortgage Payments

Mortgage payments are typically made on a monthly basis and consist of four main components, often referred to as PITI: Principal, Interest, Taxes, and Insurance. The principal represents the portion of the payment that goes toward reducing the original loan amount. Interest is the cost of borrowing that principal, determined by the loan’s interest rate. Taxes refer to property taxes levied by local governments in Dallas County, which can vary based on location and property value. Insurance includes homeowners’ insurance and, in some cases, private mortgage insurance (PMI) if your down payment is less than 20% of the home’s purchase price. Understanding these components is key to accurately predicting your monthly obligations.

Mortgage Payment Formula

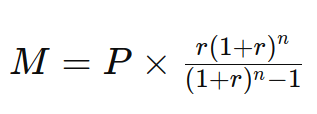

For a fixed-rate mortgage, which is a popular choice among Dallas County homebuyers for its predictability, the monthly payment (M) can be calculated using the following formula:

Where:

Where:

- P is the principal loan amount

- r is the monthly interest rate (annual interest rate divided by 12)

- n is the number of payments (loan term in years multiplied by 12)

This formula provides a baseline for your monthly principal and interest payments. However, additional costs like property taxes and insurance, which are significant in Dallas County due to varying tax rates across municipalities like Dallas, Irving, and Garland, must also be factored in. To simplify this process, Summit Lending offers an easy-to-use Loan Calculator that incorporates all relevant variables, including local tax estimates and insurance costs.

Typical Mortgage Payment Costs in Dallas County

The cost of your mortgage payment in Dallas County can vary widely depending on several factors, including the loan amount, interest rate, loan term, and additional local costs. For example, a $300,000 loan with a 4.5% interest rate over a 30-year term results in a monthly principal and interest payment of approximately $1,520. However, Dallas County property taxes, which average around 1.93% of a home’s assessed value (according to the Texas Comptroller of Public Accounts), could add another $400-$500 monthly for a home in this price range. Homeowners’ insurance, influenced by factors like proximity to flood zones in areas near the Trinity River, might add another $100-$200 per month. If PMI is required, expect an additional $50-$100 monthly until you reach 20% equity. These figures highlight the importance of considering all costs when budgeting for a home purchase or refinance. Use our Loan Calculator to get a detailed breakdown tailored to your specific situation.

How a Mortgage Calculator Can Help Dallas County Residents

Mortgage calculators are indispensable tools for anyone considering a home purchase or refinance in Dallas County. They offer a quick and accurate way to:

- Estimate your monthly mortgage payments based on current interest rates and local tax rates.

- Understand how changes in down payment amounts or interest rates impact your monthly obligations.

- Calculate the long-term savings or costs of making extra payments toward your principal.

At Summit Lending, our Loan Calculator is designed to factor in Dallas County-specific variables, such as property tax rates and insurance costs, providing a more accurate financial picture. This tool empowers you to make informed decisions, whether you’re buying a home in bustling downtown Dallas or a quieter suburb like Coppell. By using a mortgage calculator, you can plan your finances with clarity and avoid surprises down the road.

What Kind of Home Can You Afford in Dallas County?

Determining how much house you can afford in Dallas County depends on several personal and market-specific factors, including your income, existing debt, down payment savings, and current mortgage interest rates. A widely accepted guideline is that your monthly mortgage payment should not exceed 28% of your gross monthly income, and your total debt payments (including the mortgage) should not surpass 36% of your income. However, these ratios can vary based on lender requirements and individual financial circumstances.

In Dallas County, where the median home price as of late 2023 hovers around $350,000 (per data from the Texas Real Estate Research Center), affordability can be a challenge for some buyers. For a household earning $80,000 annually, a 28% ratio suggests a monthly mortgage payment of no more than $1,867, which could support a loan of approximately $300,000 with a 20% down payment and a 4.5% interest rate over 30 years. However, local factors like property taxes, which are among the highest in Texas, and rising insurance costs due to occasional severe weather events, must be considered. Summit Lending’s First Time Home Buyer resources and Pre-Approval services can help you determine a realistic budget and strengthen your position in Dallas County’s competitive market.

How to Lower Your Monthly Mortgage Payment in Dallas County

Reducing your monthly mortgage payment can significantly ease the financial burden of homeownership or refinancing, especially in a high-cost area like Dallas County. Here are several strategies to consider:

Larger Down Payment:

Increasing your down payment reduces the principal loan amount, lowering your monthly payment and potentially eliminating the need for PMI. For example, on a $350,000 home, a 20% down payment ($70,000) versus a 10% down payment ($35,000) could save you over $100 monthly in PMI alone.Longer Loan Term:

Opting for a 30-year term instead of a 15-year term spreads out the repayment period, reducing monthly payments. While this increases total interest paid over the loan’s life, it can provide short-term relief for Dallas County buyers facing high upfront costs.Refinance at a Lower Rate:

If interest rates drop or your credit improves, refinancing can lower your monthly payments. With Summit Lending’s Refinance Loans, we help you assess whether refinancing makes sense, factoring in closing costs and your plans to stay in the home.Property Tax Appeal:

Dallas County property taxes are based on assessed home values, which can sometimes be inflated. If you believe your assessment is too high, you can appeal through the Dallas Central Appraisal District, potentially reducing your tax burden by hundreds of dollars annually.Shop for Insurance:

Homeowners’ insurance rates can vary widely in Dallas County due to risks like hailstorms and flooding. Comparing policies and providers can save you $50-$100 monthly, a significant amount over time.

Why Choose Summit Lending for Your Dallas County Mortgage Needs?

At Summit Lending, we understand the unique challenges and opportunities of the Dallas County real estate market. With over 50 years of combined experience, our mortgage brokers and loan officers are equipped to guide you through every step of the home buying or refinancing process. We offer a wide range of loan products, including Purchase Loans, Refinance Loans, and specialized options like Construction Loans and Commercial Loans. Our local expertise ensures that we account for Dallas County-specific factors, such as fluctuating property taxes and market trends, when tailoring solutions to your needs.

Our commitment to personalized service sets us apart. Whether you’re a first-time buyer exploring options through our First Time Home Buyer program or a seasoned investor seeking a Reverse Loan, we provide the support and resources you need. Ready to get started? Contact us today at 385-200-1470, email us at [email protected], or visit our office at 305 E Main Street Suite 202, Tremonton, UT 84337. You can also reach out through our Contact Us page for a consultation.

Understanding the Dallas County Real Estate Market

Dallas County is one of the most dynamic real estate markets in Texas, driven by a strong economy, population growth, and a diverse housing stock. As of 2023, the county’s population exceeds 2.6 million, making it the second most populous county in Texas (U.S. Census Bureau). This growth fuels demand for housing, pushing median home prices to around $350,000, with higher values in desirable areas like Highland Park and University Park, where prices can exceed $1 million. Meanwhile, more affordable options exist in suburbs like Mesquite and Grand Prairie, appealing to first-time buyers and families.

The rental market is also robust, with Dallas County attracting investors due to high occupancy rates and rental yields. For those considering refinancing, the area’s appreciating property values. Up approximately 5-7% annually over the past few years (per Zillow data). Offer opportunities to tap into equity or secure better loan terms. However, challenges like high property taxes and insurance costs due to weather risks require careful financial planning. Summit Lending’s team stays updated on these trends to provide advice tailored to your goals, whether you’re buying, refinancing, or investing. Learn more about our approach on our About page.

Conclusion

Calculating your mortgage payments and understanding the factors that influence them are foundational steps in achieving homeownership or financial flexibility through refinancing in Dallas County, Texas. From utilizing tools like our Loan Calculator to exploring strategies for lowering monthly payments, Summit Lending is here to ensure you make informed decisions. Our deep knowledge of the Dallas County market, combined with a wide array of loan products and personalized service, positions us as your ideal partner in this journey.

Don’t let the complexities of mortgage calculations or the competitive Dallas County market hold you back. Reach out to Summit Lending today to discuss your home purchase or refinancing needs. Call us at 385-200-1470, send an email to [email protected], or visit our Contact Us page to schedule a consultation. Let us help you turn your homeownership dreams into reality with confidence and ease.