Calculate Your Mortgage Loans in Harrison County, Texas

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Calculating Mortgage Loans in Harrison County, Texas

Understanding how to calculate mortgage payments is a vital step in the journey toward homeownership or refinancing in Harrison County, Texas. Whether you're a first-time homebuyer exploring the historic neighborhoods of Marshall or a current homeowner looking to reduce monthly expenses through refinancing, having a clear grasp of your financial commitments can help you make informed decisions. Summit Lending, based in Tremonton, Utah, proudly serves clients across Texas, including Harrison County, with over 50 years of combined experience in mortgage brokering. This comprehensive guide will walk you through the essentials of mortgage calculations, the benefits of using online tools, and localized insights for Harrison County residents. We’re here to ensure you have the resources and support needed to achieve your homeownership or financial goals.

How to Calculate Your Mortgage Payments

Mortgage payments are typically made on a monthly basis and consist of four main components, often referred to as PITI: Principal, Interest, Taxes, and Insurance. The principal is the portion of the payment that goes toward repaying the original loan amount. Interest represents the cost of borrowing that money, determined by the loan’s interest rate. Taxes are property taxes assessed by local governments, which in Harrison County can vary based on location and property value. Insurance includes homeowners’ insurance and, if applicable, private mortgage insurance (PMI) for loans with less than a 20% down payment.

Calculating your mortgage payment manually can be complex due to these variables, but understanding the basics can empower you as a borrower. For a more precise estimate tailored to Harrison County’s tax rates and insurance costs, Summit Lending offers a user-friendly Loan Calculator to input your specific details and get real-time results using up-to-date interest rate data.

Mortgage Payment Formula

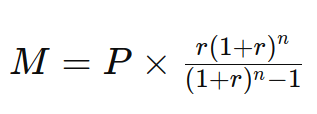

For those interested in the math behind mortgage calculations, the formula for a fixed-rate mortgage monthly payment (M) is as follows:

Where:

Where:- P is the principal loan amount (the total amount borrowed)

- r is the monthly interest rate (annual interest rate divided by 12)

- n is the number of payments (loan term in years multiplied by 12)

This formula provides the principal and interest portion of your payment. However, to get a complete picture, you’ll need to add property taxes and insurance costs, which can be significant in Harrison County due to local tax assessments. For instance, property tax rates in Harrison County average around 1.8% of assessed property value, according to data from the Texas Comptroller of Public Accounts. This means for a $200,000 home, annual taxes could be approximately $3,600, or $300 per month, added to your mortgage payment.

Typical Mortgage Payment Costs in Harrison County, Texas

The cost of your monthly mortgage payment in Harrison County will depend on several factors: the loan amount, interest rate, loan term, down payment, and additional expenses like taxes, insurance, and possible homeowners’ association (HOA) fees in certain subdivisions. As an example, a $250,000 loan with a 4.5% interest rate on a 30-year fixed term results in a monthly principal and interest payment of about $1,267. When you factor in Harrison County’s average property taxes and standard homeowners’ insurance (approximately $1,500 annually or $125 monthly), the total monthly payment could rise to around $1,692.

These figures are estimates and can vary based on individual circumstances, current market rates, and specific property locations within Harrison County, such as Marshall, Waskom, or Hallsville. To get a personalized breakdown of your potential mortgage costs, use Summit Lending’s Loan Calculator and input details like loan amount, interest rate, and estimated taxes and insurance for a more accurate projection.

How a Mortgage Calculator Can Help Harrison County Residents

Mortgage calculators are indispensable tools for anyone considering a home purchase or refinance in Harrison County. These online resources simplify complex calculations and provide clarity on your financial obligations. With Summit Lending’s calculator, you can:

- Estimate your monthly mortgage payments based on current interest rates and local tax data.

- See how adjustments in down payment or interest rates impact your monthly costs.

- Evaluate the benefits of extra payments on reducing the loan term and total interest paid over time.

Using a mortgage calculator offers a transparent view of your potential expenses, helping you plan effectively for homeownership in Harrison County. Whether you’re eyeing a historic home in Marshall or a modern build near Hallsville, this tool ensures you’re financially prepared. Access our calculator at summitlending.com/loan-calculator to start planning today.

What Kind of Home Can You Afford in Harrison County?

Determining how much home you can afford in Harrison County depends on your income, existing debt, down payment savings, and current mortgage interest rates. A widely used guideline suggests that your monthly mortgage payment should not exceed 28% of your gross monthly income, while total debt payments (including the mortgage) should stay below 36% of your income. For example, if your household earns $60,000 annually ($5,000 monthly), your mortgage payment should ideally be under $1,400 per month.

Harrison County’s median home value, according to recent data from Zillow, hovers around $180,000, which is significantly lower than the national average. This affordability, combined with a cost of living index of about 85 (compared to the U.S. average of 100), makes Harrison County an attractive market for homebuyers. However, lender requirements and personal financial goals can influence these affordability benchmarks. Summit Lending’s team can assist with pre-approval to determine your exact borrowing capacity and help you find a home within your budget.

How to Lower Your Monthly Mortgage Payment in Harrison County

Reducing your monthly mortgage payment can make owning a home in Harrison County more sustainable and financially comfortable. Here are several strategies to consider, tailored to local conditions:

Larger Down Payment:

Increasing your down payment lowers the principal loan amount, reducing monthly payments and potentially eliminating PMI. For Harrison County buyers, where homes are relatively affordable, saving for a 20% down payment on a $180,000 home ($36,000) can significantly cut costs.Longer Loan Term:

Choosing a longer loan term, such as 30 years instead of 15, spreads out payments over more time, lowering monthly costs. However, this increases total interest paid over the loan’s life.Refinance for Better Rates:

If you already own a home in Harrison County, refinancing at a lower interest rate through Summit Lending’s Refinance Loans can reduce monthly payments. Be mindful of closing costs and how long you plan to stay in the home to ensure savings outweigh expenses.Property Tax Appeal:

Property taxes in Harrison County can be a significant portion of your payment. If you believe your home’s assessed value is inflated, you can appeal through the Harrison County Appraisal District to potentially lower your tax burden.Shop for Affordable Insurance:

Homeowners’ insurance rates can vary widely. Comparing policies and providers can save you money on monthly escrow payments, especially in East Texas where weather-related risks like storms might affect premiums.

Why Choose Harrison County, Texas, for Home Buying and Refinancing?

Harrison County offers a compelling mix of affordability, community, and opportunity for homebuyers and those looking to refinance. With a population of approximately 68,000, the county provides a slower-paced lifestyle compared to urban centers like Dallas or Houston, yet it’s within driving distance of Shreveport, Louisiana, for additional amenities. The local economy is supported by industries such as oil and gas, education (with institutions like Wiley College in Marshall), and healthcare, providing stable employment opportunities.

For homebuyers, the county’s median home prices and lower cost of living mean you get more value for your money. First-time buyers can take advantage of Summit Lending’s First Time Home Buyer programs to navigate the process with ease. For current homeowners, refinancing offers a chance to tap into equity or lower payments as interest rates fluctuate. According to recent reports from the Federal Reserve, mortgage rates remain competitive as of 2023, making it an opportune time to explore refinancing options with Summit Lending.

Why Partner with Summit Lending?

At Summit Lending, we’re committed to serving Harrison County residents with personalized mortgage solutions. Our team of experienced brokers and loan officers, accessible through our Loan Officers page, brings over 50 years of combined expertise to the table. We understand the nuances of the Texas real estate market and are dedicated to helping you secure the best loan products, whether for purchase loans, refinancing, or other needs like construction loans.

We pride ourselves on transparency and client satisfaction, as evidenced by numerous 5-star reviews on our Testimonials page. Our services extend across Utah, Idaho, Wyoming, and Texas, with plans to expand further, ensuring we bring a broad perspective and localized knowledge to your mortgage journey.

Conclusion and Call to Action

Calculating mortgage payments and understanding your financial options are crucial steps toward achieving homeownership or financial flexibility in Harrison County, Texas. From utilizing tools like Summit Lending’s Loan Calculator to exploring strategies for lowering payments, you have the resources to make informed decisions. The unique affordability and charm of Harrison County make it a prime location for buying a home or refinancing an existing mortgage.

Ready to take the next step? Summit Lending is here to help. Contact us today for personalized guidance on mortgage loans tailored to your needs. Reach out via email at [email protected], call us at 385-200-1470, or visit our office at 305 E Main Street Suite 202, Tremonton, UT 84337. You can also explore more about our services or get in touch through our Contact Us page. Let Summit Lending be your trusted partner in navigating the mortgage process in Harrison County, Texas.