Calculate Your Mortgage Loans in Uvalde County, TX

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Calculating Mortgage Loans for Home Purchases and Refinancing in Uvalde County, TX

Navigating the mortgage process can be a daunting task, whether you're a first-time homebuyer or looking to refinance an existing loan in Uvalde County, Texas. Understanding how to calculate your mortgage payments is essential for effective budgeting, future planning, and ensuring you can afford the home of your dreams or optimize your current financial situation. At Summit Lending, we’re committed to simplifying this process for residents of Uvalde County by providing expert guidance and access to powerful tools like our Loan Calculator. This comprehensive guide will walk you through calculating mortgage payments, the costs involved, how calculators can assist, determining affordability, and strategies to lower your payments, all tailored to the unique housing market of Uvalde County.

Why Uvalde County, Texas, for Home Buying and Refinancing?

Uvalde County, located in the heart of South Texas, is an appealing destination for prospective homeowners and those seeking refinancing opportunities. With a population of approximately 24,000 as of the latest U.S. Census data, Uvalde County offers a slower pace of life compared to bustling urban centers like San Antonio or Austin, while still providing access to essential amenities. The median home price in Uvalde County is significantly lower than the Texas state average, often hovering around $150,000 to $200,000 according to recent real estate data from sources like Zillow and Redfin. This affordability makes it an attractive option for first-time buyers or families looking to settle in a community with strong cultural roots and natural beauty, including proximity to Garner State Park and the Frio River.

For homeowners considering refinancing, Uvalde County’s stable housing market and potential for property value appreciation present opportunities to secure better loan terms or access equity for home improvements. Whether you're drawn to the area's historic charm, affordable living costs, or outdoor recreational opportunities, Summit Lending is here to help you achieve your mortgage goals. Contact us at [email protected] or call 385-200-1470 to discuss your options.

How to Calculate Your Mortgage Payments

Mortgage payments are typically made on a monthly basis and consist of four main components, often referred to as PITI: Principal, Interest, Taxes, and Insurance. The principal represents the portion of the payment that goes toward repaying the original loan amount. Interest is the cost of borrowing that principal, determined by your loan’s interest rate. Taxes refer to property taxes assessed by local authorities in Uvalde County, which can vary based on the assessed value of your property. Insurance includes homeowners’ insurance to protect against damages and, in some cases, private mortgage insurance (PMI) if your down payment is less than 20% of the home’s purchase price.

Understanding these components is crucial for residents of Uvalde County, where property tax rates are set by local entities like the Uvalde County Appraisal District. According to recent data, the average effective property tax rate in Uvalde County is approximately 1.8%, slightly below the Texas state average of 1.9%. This can impact your monthly payment significantly, so factoring it into your calculations is essential.

Mortgage Payment Formula

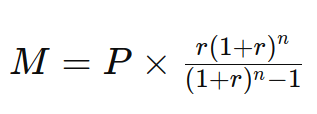

For a fixed-rate mortgage, which is a popular choice for its predictability, the monthly payment (M) can be calculated using the following formula:

Where:

Where: - P is the principal loan amount (the total amount borrowed)

- r is the monthly interest rate (annual interest rate divided by 12)

- n is the number of payments (loan term in years multiplied by 12)

For example, if you’re purchasing a home in Uvalde County for $180,000 with a 4.5% annual interest rate on a 30-year fixed-rate mortgage and a 10% down payment, your principal would be $162,000. Using the formula, your monthly payment for principal and interest alone would be approximately $821. However, this does not include taxes or insurance, which can add several hundred dollars depending on local rates and coverage. For a precise calculation tailored to your situation, use our Loan Calculator to input all relevant details, including current interest rates and additional costs.

Typical Mortgage Payment Costs in Uvalde County

The total cost of your monthly mortgage payment in Uvalde County will depend on multiple factors: the loan amount, interest rate, loan term, and additional expenses like property taxes, insurance, and possibly homeowners’ association (HOA) fees if applicable. For a $200,000 loan with a 4% interest rate over a 30-year term, the principal and interest payment would be around $955 per month. Adding in Uvalde County’s property taxes (approximately $300/month for a $200,000 home at a 1.8% rate) and standard homeowners’ insurance (about $100/month), the total monthly payment could rise to around $1,355.

These figures are estimates and can vary based on individual circumstances, such as credit score, down payment size, and specific lender requirements. Additionally, rural areas of Uvalde County might have different tax assessments compared to properties closer to the city of Uvalde. For a detailed breakdown specific to your financial profile and property location, reach out to Summit Lending or use our Loan Calculator for real-time estimates with up-to-date interest rate data.

How a Mortgage Calculator Can Help Uvalde County Residents

Mortgage calculators are indispensable tools for anyone considering a home purchase or refinance in Uvalde County. These tools provide clarity and help you make informed decisions by allowing you to:

- Estimate your monthly mortgage payments based on loan amount, interest rate, and term

- Understand how variations in interest rates or down payments impact your monthly costs

- Calculate the benefits of making extra payments to reduce the loan term and total interest paid

Using Summit Lending’s Loan Calculator, you can input specific data relevant to Uvalde County, such as local tax rates and insurance costs, to get a more accurate picture of your financial commitments. This transparency is vital for planning, especially in a market like Uvalde where housing costs are more affordable, but additional expenses like taxes can still add up.

What Kind of Home Can You Afford in Uvalde County?

Determining how much house you can afford in Uvalde County depends on several personal financial factors: your income, existing debt, down payment amount, and the current mortgage interest rates. A widely accepted guideline is the 28/36 rule, which suggests that your monthly mortgage payment should not exceed 28% of your gross monthly income, and your total debt payments (including the mortgage) should not surpass 36% of your gross income. For instance, if your household earns $5,000 per month, your mortgage payment should ideally be under $1,400, and total debt payments should not exceed $1,800.

In Uvalde County, where median household incomes are around $45,000 annually according to the U.S. Census Bureau, this translates to an affordable home price range of approximately $150,000 to $200,000 for many families, assuming a 10-20% down payment and favorable interest rates. However, these figures can vary based on individual circumstances and lender criteria. Summit Lending offers personalized assistance for first-time home buyers and can help you navigate pre-approval to determine your exact budget.

How to Lower Your Monthly Mortgage Payment in Uvalde County

Reducing your monthly mortgage payment can make homeownership or refinancing more manageable, especially in a community-focused area like Uvalde County. Here are several strategies to consider:

Larger Down Payment:

Increasing your down payment lowers the principal loan amount, reducing your monthly payment and potentially eliminating the need for PMI. For example, on a $180,000 home in Uvalde, a 20% down payment ($36,000) could save you hundreds per month compared to a 5% down payment.Longer Loan Term:

Choosing a longer loan term, such as 30 years instead of 15, spreads out repayments, lowering monthly costs. However, this increases the total interest paid over the loan’s life.Refinance for Better Rates:

Refinancing at a lower interest rate can significantly cut monthly payments. With Summit Lending’s refinance loans, Uvalde County homeowners can explore options to reduce rates or adjust terms, though closing costs and your planned duration in the home should be considered.Property Tax Appeal:

If you believe your home’s assessed value is inflated, appealing your property tax assessment through the Uvalde County Appraisal District could lower your tax burden, reducing monthly escrow payments.Shop for Insurance:

Comparing homeowners’ insurance providers can yield better rates, cutting monthly costs. In Uvalde County, where weather-related risks like flooding near rivers may apply, finding competitive rates is key.

Conclusion: Partner with Summit Lending in Uvalde County

Calculating mortgage payments and understanding the factors that influence them are critical steps in the home-buying or refinancing process in Uvalde County, Texas. By leveraging tools like Summit Lending’s Loan Calculator, considering all associated costs, and exploring strategies to reduce monthly payments, you can make informed decisions that align with your financial goals. Whether you’re captivated by Uvalde’s affordable housing, scenic beauty, or community spirit, our team at Summit Lending is ready to assist.

With over 50 years of combined experience, our mortgage brokers and loan officers are dedicated to helping you navigate the complexities of purchase loans, refinance loans, and more across Texas, including Uvalde County. Don’t leave your mortgage journey to chance—reach out to us today for personalized support. Visit our Contact Us page, email us at [email protected], or call 385-200-1470 to speak with one of our loan officers. Let Summit Lending help you secure the keys to your future in Uvalde County!