Calculate Your Mortgage in Garden City, Utah

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Mortgage Loan Calculator for Home Purchases and Refinancing in Garden City, Utah

At Summit Lending, we recognize that purchasing a home or refinancing a mortgage in Garden City, Utah, is a major financial commitment. Nestled near the shores of Bear Lake, often called the 'Caribbean of the Rockies' for its turquoise waters, Garden City offers a picturesque setting for families and retirees alike. To support your journey, we’ve developed an intuitive mortgage loan calculator to help you estimate monthly payments and plan your budget effectively. Whether you’re a first-time home buyer captivated by the area’s recreational opportunities or a homeowner seeking to refinance for better terms, our tool delivers personalized results using current interest rates. Based in Tremonton, Utah, Summit Lending proudly serves Garden City and beyond with over 50 years of combined experience in the mortgage industry.

Calculate Your Mortgage Loan Today

Understanding your mortgage payment is a critical step in the home-buying process in Garden City, Utah. Our loan calculator helps you budget, confirm affordability, and plan financially for the future. With Garden City’s unique appeal as a gateway to outdoor activities like boating, fishing, and hiking, ensuring you can afford your dream home here is essential.

Breaking Down Your Mortgage Payment

Your monthly mortgage payment in Garden City will typically include four components, often referred to as PITI. Consider these when using our home loan calculator:

- Principal (P): The portion of your payment that reduces the original loan amount.

- Interest (I): The cost of borrowing the principal, based on your loan’s interest rate.

- Taxes (T): Property taxes, which in Utah average around 0.6% of home value annually, according to the Tax Foundation. Among the lowest in the nation.

- Insurance (I): Homeowners’ insurance and potentially private mortgage insurance (PMI) if your down payment is less than 20%.

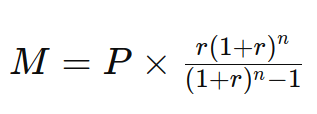

Mortgage Payment Formula with Our Calculator

Use this formula to calculate your fixed-rate home loan payment (denoted as 'M' for mortgage) each month:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in years multiplied by 12)

Expected Costs for Mortgage Payments in Garden City

For example, if you secure a 30-year loan for $250,000 at a 4% interest rate, your monthly principal and interest payment would be approximately $1,193. Adding Garden City’s property taxes, insurance, and possible homeowners’ association fees will increase this amount. According to recent data from the Utah Association of Realtors, the median home price in rural areas like Garden City hovers around $400,000 as of 2023, reflecting its growing popularity as a vacation and retirement destination. Use our Mortgage Calculator for a detailed breakdown tailored to your situation.

Why Use a Mortgage Loan Calculator for Garden City?

The mortgage process can be overwhelming, with variables like interest rates, loan terms, and local property taxes influencing your payments. Our calculator simplifies this by offering a clear snapshot of your potential costs in Garden City, Utah. Here’s why it’s an invaluable tool:

- Estimate Monthly Payments: Input your loan amount, interest rate, and term to preview your monthly obligation.

- Compare Loan Scenarios: Experiment with different terms, such as 15-year versus 30-year mortgages, to find what suits your budget.

- Account for Additional Costs: Include Garden City’s property taxes, homeowners insurance, and PMI if applicable for a realistic estimate.

- Explore Refinancing Savings: See how refinancing at a lower rate or adjusted term could reduce your costs over time.

Our calculator uses real-time market data to reflect current conditions, ensuring accuracy as you plan your home purchase or refinance in Garden City. For more personalized insights, connect with our team via Contact Us.

Home Buying in Garden City, Utah

Garden City, Utah, is a hidden gem for home buyers, offering a serene lifestyle with proximity to Bear Lake State Park. Known for its vibrant summer tourism and peaceful winters, this small town of approximately 600 residents (according to the U.S. Census Bureau, 2020) provides a unique opportunity for those seeking vacation homes or permanent residences. Here are some reasons Garden City stands out:

- Natural Beauty: Bear Lake’s stunning turquoise waters and surrounding mountains offer endless outdoor activities, from boating and fishing in summer to snowmobiling in winter.

- Affordability: Compared to larger Utah markets like Salt Lake City, Garden City offers more affordable entry points for home buyers, though seasonal demand can influence prices. The median home price is around $400,000, as noted by local real estate trends in 2023.

- Community and Tourism: Garden City hosts events like the Raspberry Days Festival, boosting local economy and community spirit, making it attractive for families and investors alike.

- Low Property Taxes: Utah’s property tax rate of 0.6% is a significant advantage for homeowners in Garden City, keeping annual costs lower than in many other states.

Use our loan calculator to estimate how much home you can afford in Garden City, and explore our Purchase Loans page or consult with our Loan Officers for expert guidance tailored to this area.

Refinancing Your Mortgage in Garden City with Summit Lending

Refinancing can be a strategic move for Garden City homeowners looking to lower monthly payments, adjust loan terms, or tap into home equity. With Bear Lake properties often appreciating due to tourism demand, now could be an ideal time to explore options. Our calculator lets you compare current loan details with new terms to identify potential savings. Benefits of refinancing include:

- Lower Interest Rates: If rates have decreased since your original mortgage, refinancing could save significant money. As of late 2023, Freddie Mac reports average 30-year fixed rates around 6.5%, though individual rates vary based on credit and market trends.

- Adjusted Loan Terms: Switch to a shorter term like 15 years to pay off faster, or extend to reduce monthly payments.

- Cash-Out Refinance: Leverage your home’s equity for renovations, debt consolidation, or other needs. Particularly useful for upgrading vacation rentals in Garden City.

Summit Lending offers tailored refinancing solutions for Garden City residents. Visit our Refinance Loans page to learn more about saving with us.

How to Use Our Mortgage Loan Calculator

Our easy-to-use calculator provides quick estimates for Garden City home buyers and homeowners. Follow these steps:

- Enter Loan Amount: Input the amount you wish to borrow or your current balance for refinancing.

- Choose Loan Term: Select from terms like 15, 20, or 30 years.

- Add Interest Rate: Use the default rate based on current data or input a quoted rate.

- Include Additional Costs: Factor in Garden City’s property taxes, insurance, and PMI if applicable. Utah’s low tax rates can be confirmed via local county resources.

- Review Results: See your estimated monthly payment, total interest, and amortization schedule instantly.

While this tool is a great starting point, every mortgage is unique. For a custom quote or to discuss specific programs, call us at 385-200-1470 or email [email protected].

Why Choose Summit Lending for Garden City Mortgages?

With over 50 years of combined experience, Summit Lending is your trusted partner for mortgages in Garden City, Utah. Here’s why we stand out:

- Local Knowledge: We understand Garden City’s unique market, from seasonal property demand to year-round living costs.

- Diverse Loan Options: We offer everything from purchase and refinance loans to construction loans, reverse mortgages, and commercial loans.

- Client-First Approach: Our brokers guide you through every step. See client feedback on our Testimonials page.

- Helpful Resources: Access tools like pre-approval assistance and support for first-time home buyers.

Located at 305 E Main Street Suite 202, Tremonton, UT, we’re just a call or visit away. Learn more about us on our About page.

Understanding Mortgage Factors in Garden City, Utah

Mortgage costs in Garden City are influenced by local factors. Property taxes in Utah are low at 0.6% of home value annually, per the Tax Foundation, providing cost savings for homeowners. However, the seasonal nature of the Bear Lake area can drive demand and prices, especially for lakefront properties. Inventory may be limited due to the small population and high tourist appeal, so working with a knowledgeable broker like Summit Lending is key. Additionally, homeowners insurance may be higher if your property is near the lake due to potential flood risks, though Bear Lake’s stable water levels mitigate some concerns. Use our calculator to factor in these costs, and connect with our loan officers for detailed local insights.

Take the Next Step with Summit Lending in Garden City

Ready to make your Garden City homeownership dreams a reality? Use our mortgage loan calculator to start, then contact Summit Lending for a personalized consultation. Call us at 385-200-1470, email [email protected], or visit our Tremonton office. Stay informed with mortgage tips on our Blog.

Don’t let financial uncertainty stop you from owning a home by Bear Lake. Summit Lending is your partner in navigating home purchases and refinancing in Garden City, Utah. Start calculating today and take the first step toward a brighter future!

Disclaimer: Results from our mortgage loan calculator are estimates based on provided data and current market conditions. Actual terms, rates, and payments may vary. For precise quotes and loan approval, contact Summit Lending directly.